Western Local Land Services (LLS) Rangeland Carbon Conference was held in Cobar on the 28th and 29th of October. A couple of key questions from this conference were, which methodology can I use on my property and what impact does the income have on my tax return?

Vegetation and sequestration projects generate abatement by removing carbon dioxide from the atmosphere and storing it as carbon in soil or in plants as they grow. Examples of vegetation and sequestration activities could include:

- reforestation

- revegetation

- protecting native forest or vegetation that is at imminent risk of clearing, or

- increasing carbon in soil

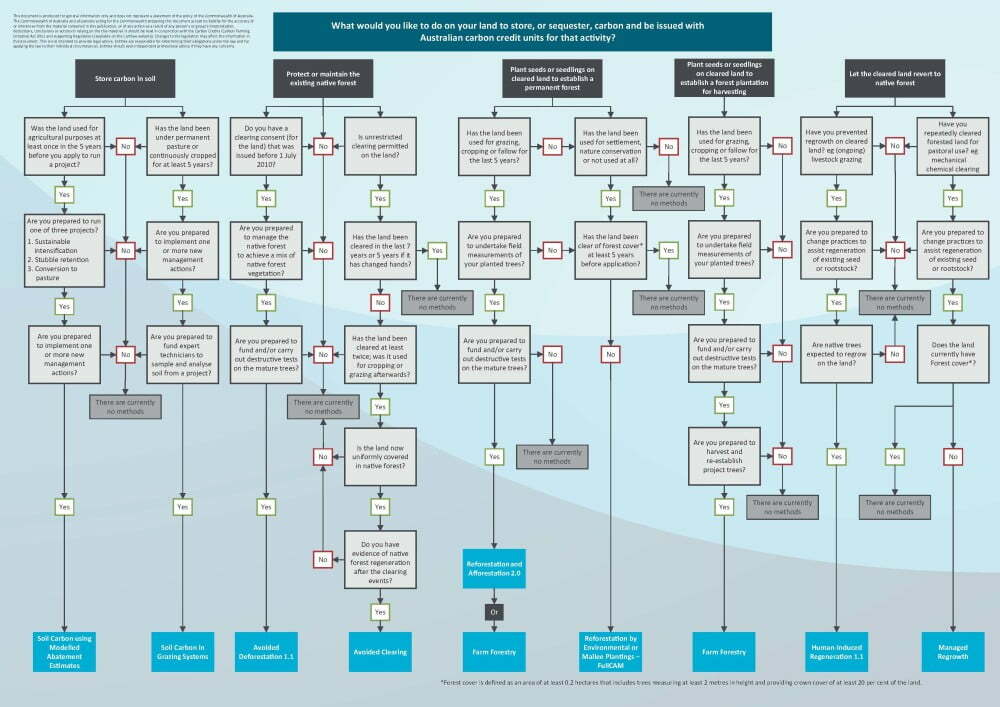

The question most people wanted to know was which methodology to use on my property? To assist landowners in selecting which methodology to use on their property a “Sequestration Decision Tree” has been created. This decision tree will help you decide which methodology to use on your property and to determine if you are eligible to generate Australian Carbon Credit Units (ACCUs). To view the decision making tree, please click on the image above, you can also read more about the options available on the <a href=”http://www.cleanenergyregulator.gov take a look at the site here.au/ERF/Choosing-a-project-type/Opportunities-for-the-land-sector/Vegetation-and-sequestration-methods” target=”_blank”>Clean Energy Regulators webpage that talks about vegetation and sequestration.

Another key point which was raised at the conference was, the income which is derived from the sale of ACCUs and the associated tax implications. It was explained that the income generated from the sale of ACCUs was NOT primary production income and could not be declared as such. This is further explained under Division 420 on the Australian Taxation Office website.

To view the information on the ATO website, please click the link below.

https://www.ato.gov.au/Business/Large-business/In-detail/Clean-energy-initiative/Clean-energy-measure—income-tax-and-GST-implications/?page=5